Albania – ranked 15th among the best tax optimized countries out of 38 selected countries worldwide!

Albania – ranked 15th among the best tax optimized countries out of 38 selected countries worldwide!

Albania – Choice of residence: paradises, alternatives and important aspects – Strategies for international business activities

Use a country with a low tax like Albania with only 15%.

Albania, on Southeastern Europe’s Balkan Peninsula, is a small country with Adriatic and Ionian coastlines and an interior crossed by the Albanian Alps. The country has many castles and archaeological sites. Capital Tirana centers on sprawling Skanderbeg Square, site of the National History Museum, with exhibits spanning antiquity to post-communism, and frescoed Et’hem Bey Mosque.

Residency and/ or Citizenship

According to Art. 9 of the Albanian Citizenship Law, is it possible for persons who significantly support the country of Albania and thus represent a certain importance for the country to obtain citizenship of Albania in this way.

Background and Legal Considerations

Several countries have adopted provisions that allow the acquisition of citizenship on the basis of an investment and/or a direct contribution to the state as a means of development of the country. In Albania, Art. 9 of the Albanian Citizenship Act Law on Albanian Citizenship, Law No. 8389, 6 September 1998, states that the government can reward foreign persons with citizenship in the event of extraordinary merit. This may take various forms, including economic ones, and can include capital contribution or other economic benefit brought to Albania. However, citizenship is not granted on the basis of capital contribution alone. The foreign investor must make an extraordinary contribution alongside his investment, such as bringing new technologies to the country or creating a substantial number of new jobs.

Benefits

When you acquire citizenship under the Albanian Citizenship Act, you and your family enjoy full citizenship for life, which can be passed on to future generations by descent.

- Citizenship in a European Country and Schengen member state that is stable, neutral and highly respected

- efficient application process

- Visa-free travel to more than 115 countries in the world. Albanian citizenship gives right of establishment in all 27 EU countries and of course, Schengen Area, India, Iran, Malaysia, Brazil etc..

- E-2 “Investor Visa” signed between Albania and the U.S. allows citizens of Albania to operate a substantial business in the U.S. and reside therein; For a standard multi- entry- Visa of 10 years for U.S. ,you need 48 ours.

- The investment is considered as a lifetime investment, from which your children’s children and the coming generations can take advantage without further expenses.

- GCI UNIT Worldwide has an experienced and highly professional expert team and lawyers, with strong connections to the Government of Albania and real estate industry, this allows you to take advantage of lucrative and valuable real estate opportunities, which are exclusively available to GCI UNIT Worldwide clients.

- Based on feedback’s of current clients of GCI UNIT Worldwide, Albanian real estate market offers stable investment opportunities with reasonable returns.

- The Albanian citizenship gives you the possibility to expand your given business or take advantage of new business and investment opportunities in the EU.

- If your products are of 51% from Albania, you can export to Russia and European Tax free! (sometimes only 1%)

- Our Albanian team and I personally are taking your application with the highest priority and we fully dedicate ourselves to your needs and support you in every aspect during the acquisition of the real estate and subsequently the application for the citizenship of Albania.

- Opportunity to become an EU citizen in around 5 years, because Albania it is already a Candidate for the full EU membership.

- There is no need to spend any particular time actually residing in Albania

- Albania has the cheapest Income Tax in Europe with only 15%

We believe that Albania is one of the best place to invest when it comes to starting a business in Europe. It is one of the biggest growth markets within Europe. All companies get subventions as soon as they hire employees. It is the European country with the lowest tax rate of only 15%. The cost of living is the cheapest in Europe. The same applies to the labor costs. Real estate and land are very cheap to buy.

Performance Guarantee

The granting of citizenship is at the sole discretion of the Government of the Republic of Albania, and we are unable to guarantee that applications will be approved. However, great care has been taken to provide the best possible safeguards for persons entering the program. Prior to taking on any mandate, a written agreement is made between the applicant and GCI UNIT Worldwide defining the responsibilities of both parties.

Strategies for international business activities

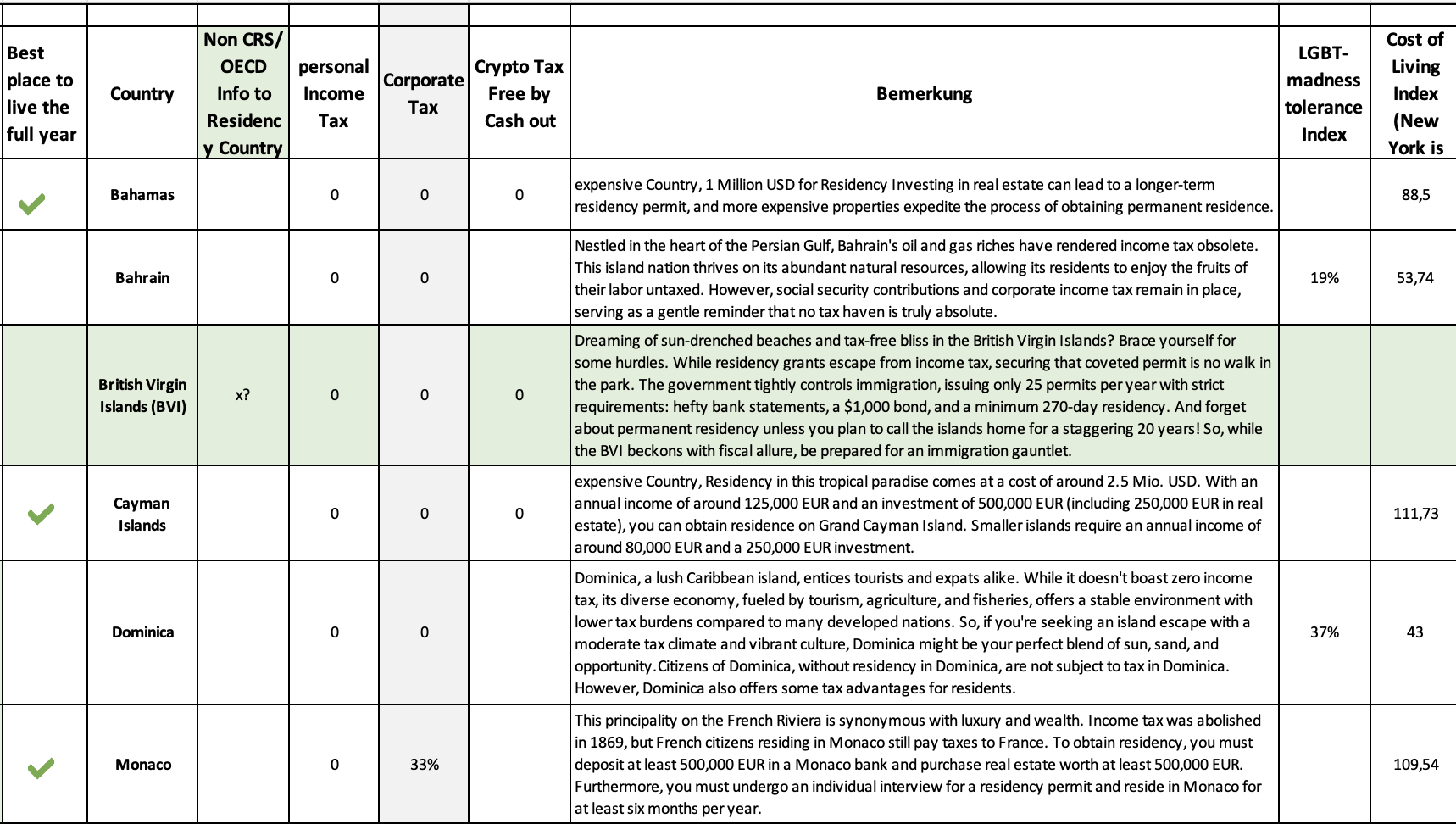

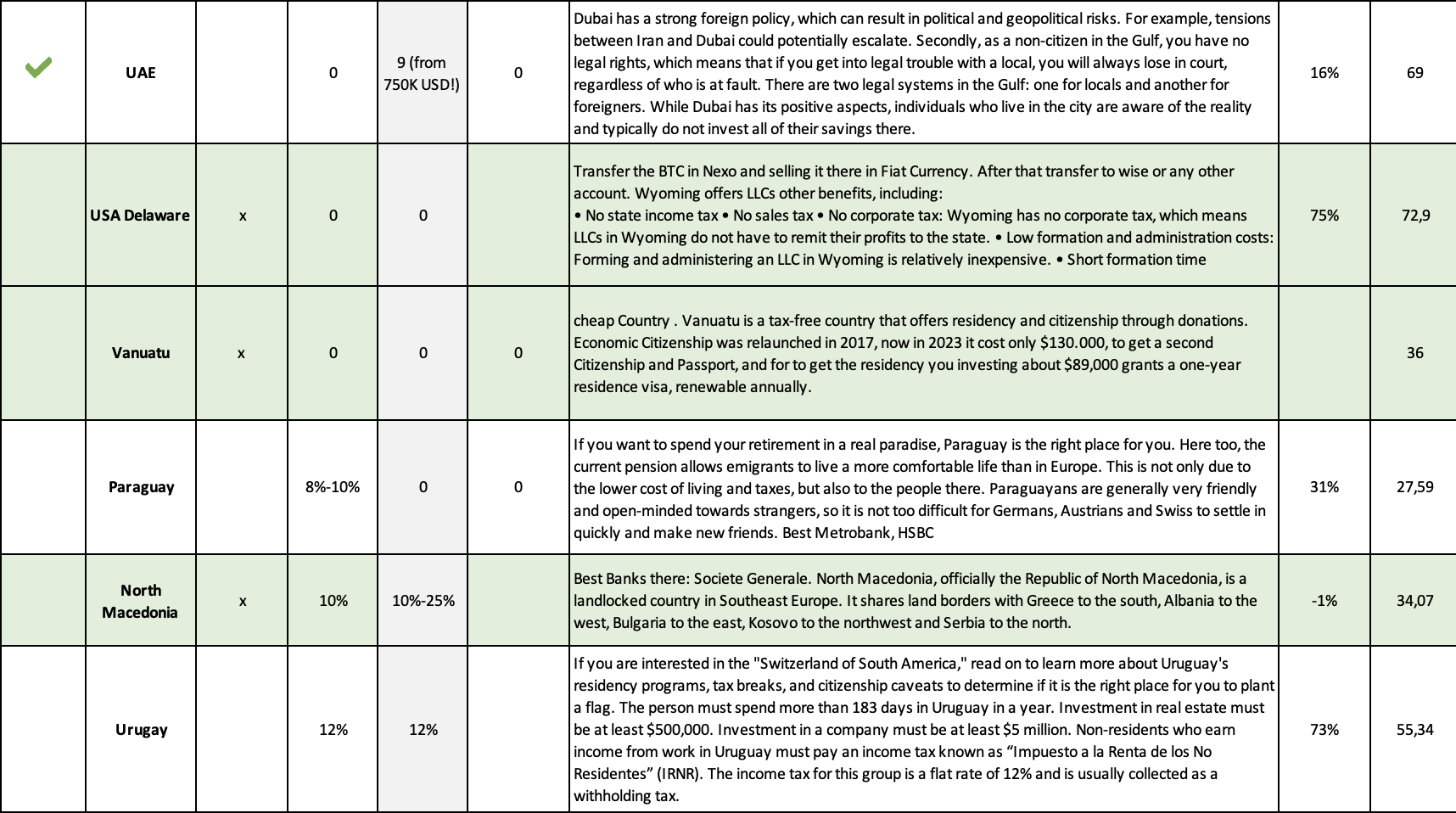

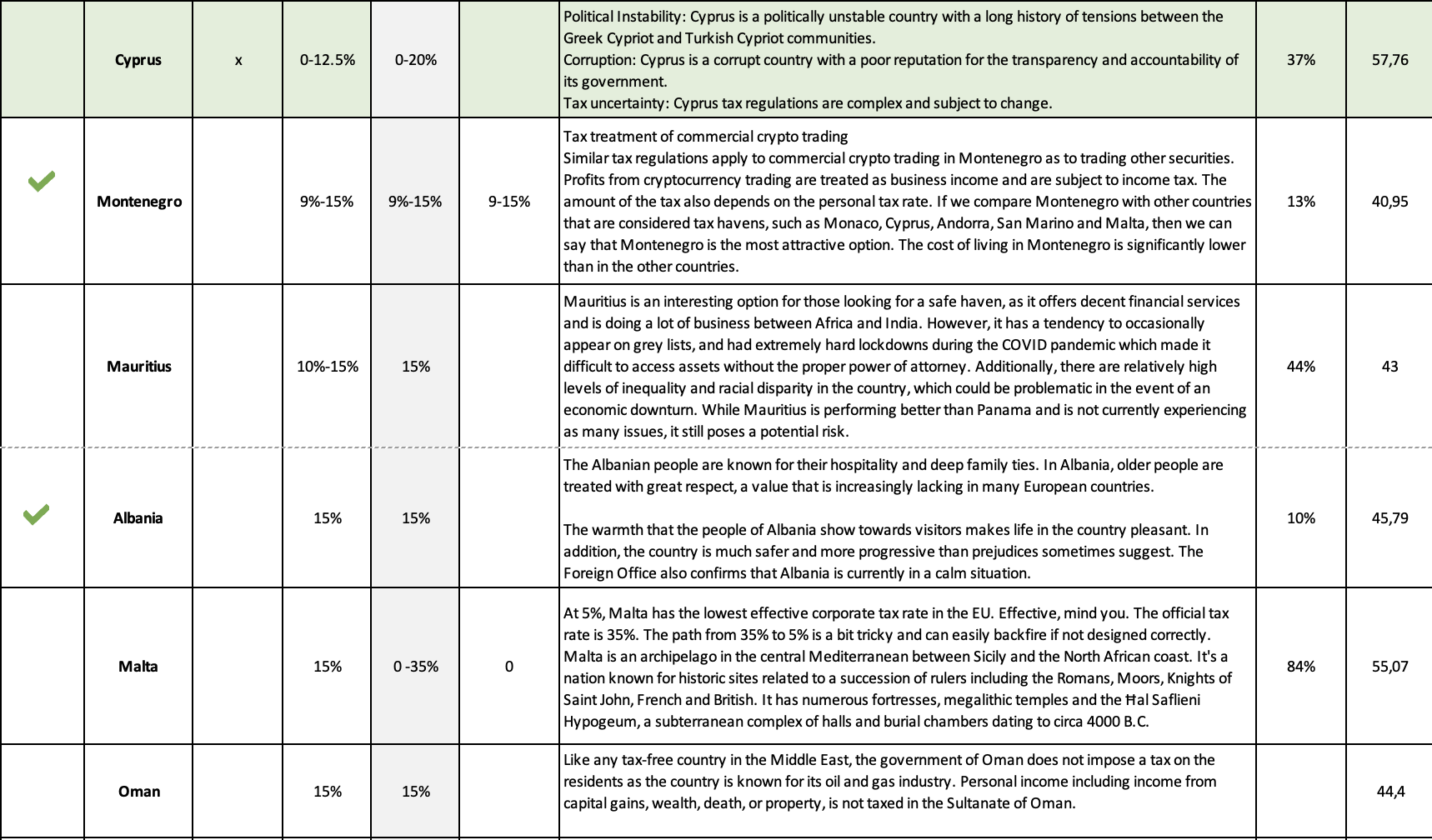

Tax-optimized choice of residence: paradises, alternatives and important aspects

The search for a residence with an optimal tax burden is a relevant topic for many people. Below we look at various options and the factors associated with them.

Tax havens with 0% tax:

Countries such as Vanuatu, Bahamas, Bahrain, British Virgin Islands and Cayman Islands lure with the promise of no income tax at all.

Countries with a low tax burden:

An attractive alternative is offered by countries such as Paraguay, Oman, Montenegro, Malta, Georgia, Albania, Serbia, North Macedonia, Uruguay, UAE, Singapore and Mauritius.

They are characterized by low income taxes and corporate taxes and at the same time offer:

• Higher standard of living and infrastructure: The quality of life and infrastructure in these countries are often significantly better compared to tax havens.

• Greater opportunities for international activities: The connection to the global economy and the opportunities for international business relations are better developed.

• Lower reputation risk: These countries generally enjoy a better international reputation.

Residence and company formation strategy:

The combination of residence in a low-tax country and the formation of a company in an offshore company with a low tax rate can further reduce the tax burden. However, the following applies:

Taxation of profit distributions: Profits distributed from the offshore company to the country of residence are generally subject to taxation.

Complexity and legislation: Implementing and managing this strategy requires in-depth knowledge of tax law and international corporate structures.

In many countries that follow the territorial tax principle, both companies and individuals are taxed primarily on domestic income. Accordingly, foreign sources of income, such as profits from foreign branches, dividends or service income, are only subject to tax if they are transferred to the respective country or are considered to have been transferred. If this income has already been taxed in the country of origin, double taxation can be avoided.

The remittance basis of taxation and the non-dom status

In the context of the non-dom status, the so-called “remittance basis of taxation” plays a central role. This term makes it clear that only foreign income that has been transferred (“remitted”) to the country of residence or consumed there is subject to tax.

Target group for the non-dom status

The non-dom status is particularly suitable for people who are internationally active both privately and professionally and who earn foreign income of more than €250,000. A key criterion is the possibility of generating passive income abroad.

Particular interest for company founders

The Non Dom status offers attractive advantages to company founders and entrepreneurs who generate high sales with foreign subsidiaries and want to receive these tax-free.

Example scenario: Tax optimization through a US LLC

Let’s assume you set up a tax-free LLC in the USA. This generates commissions of $500,000 by working with Asian partners (you can find more information on setting up a company in the USA here). As a Non Dom status holder, you enjoy complete tax exemption on these $500,000 as long as they are not transferred to an account in your country of residence.

Disclaimer:

Please note that this is only a general overview and individual tax advice from an expert is required to assess the specific impact of the Non Dom status on your situation.

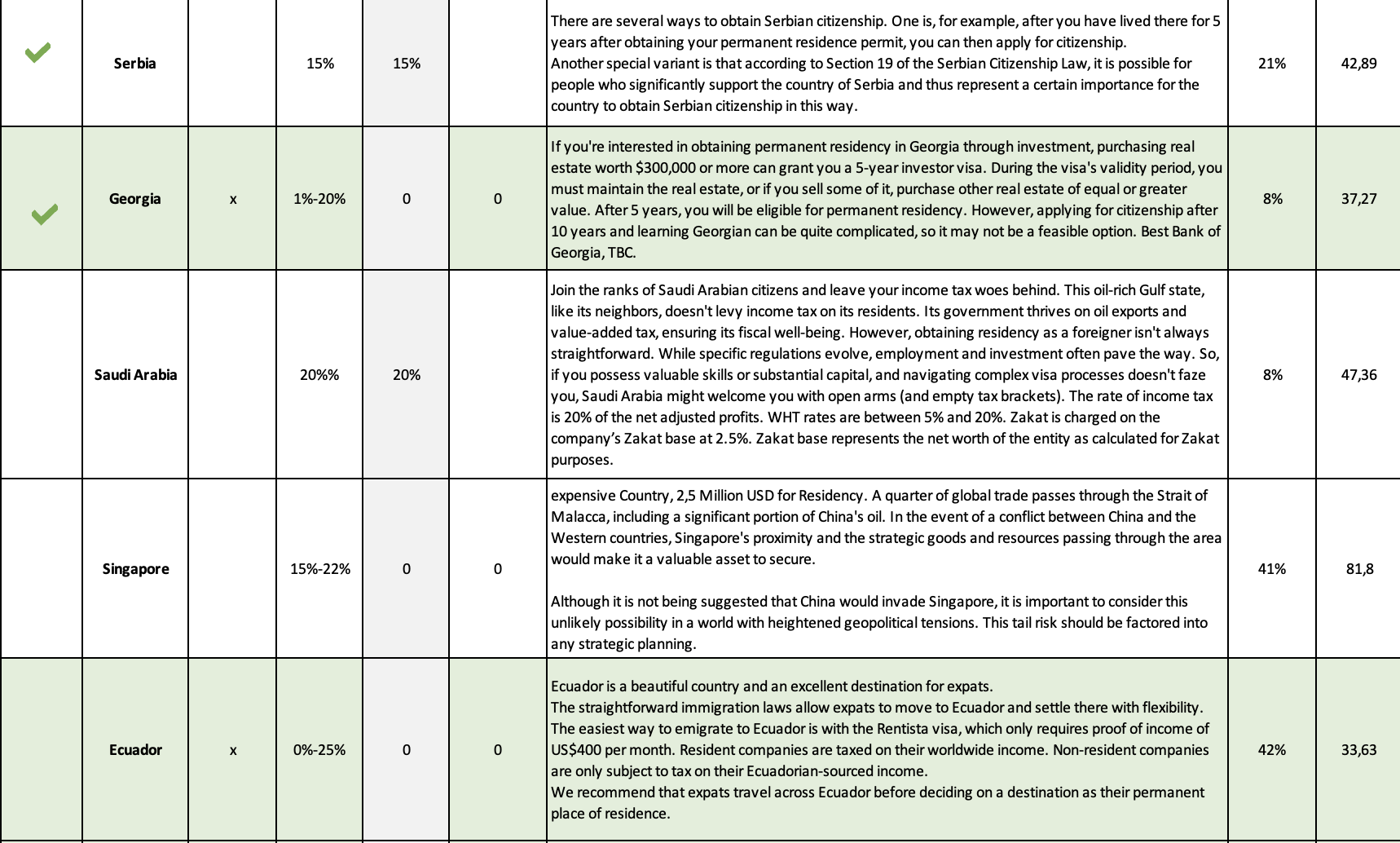

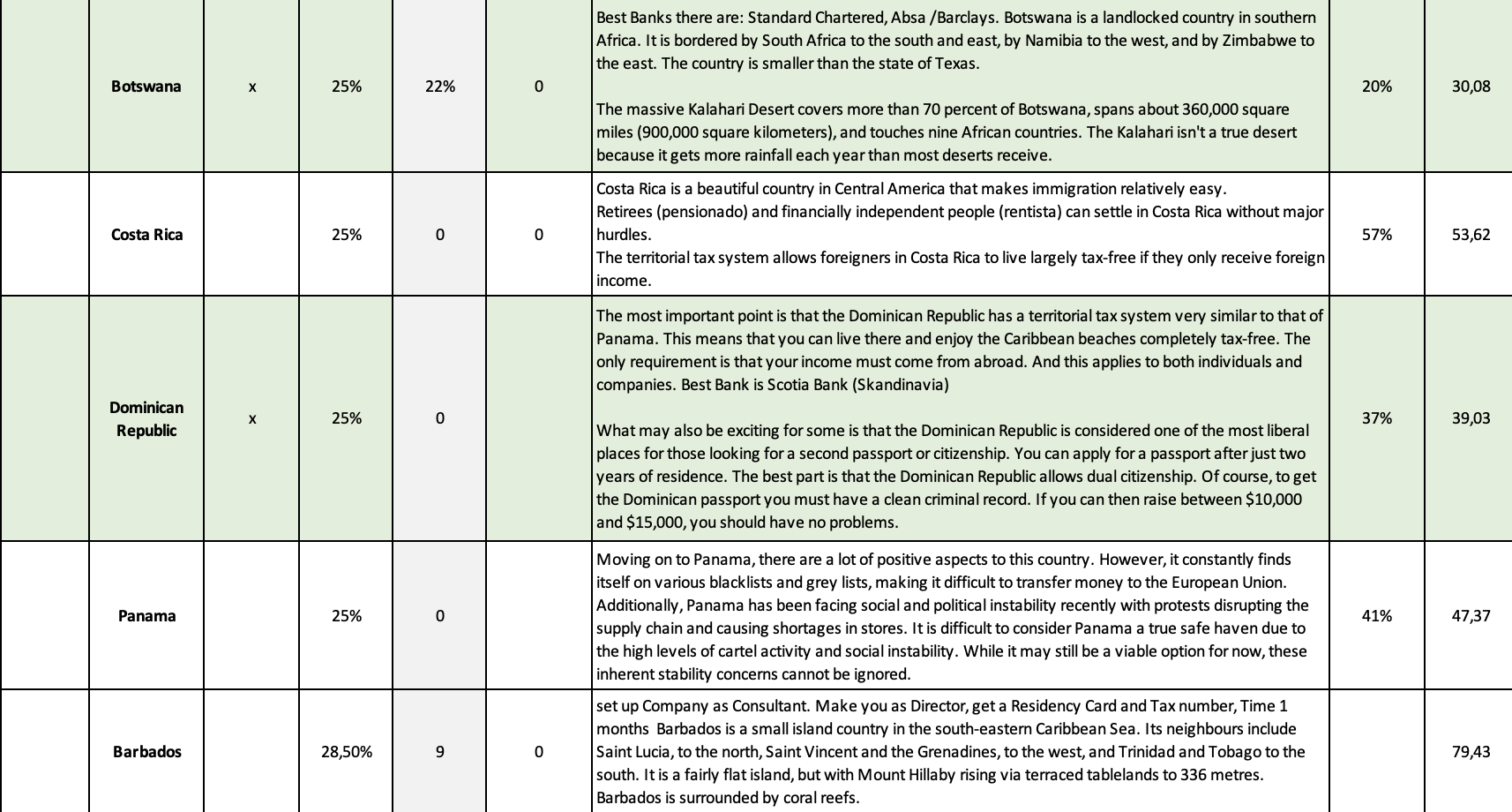

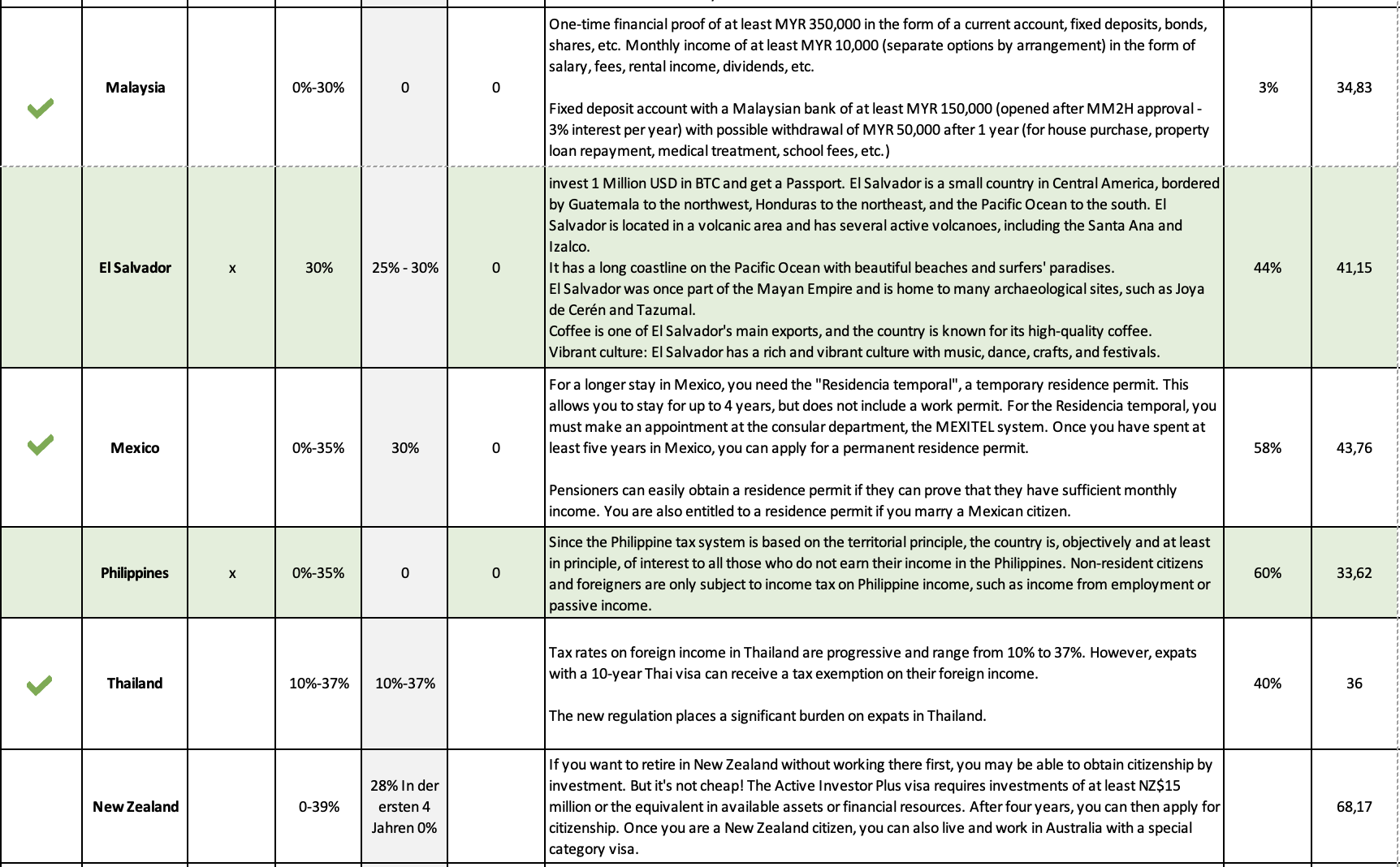

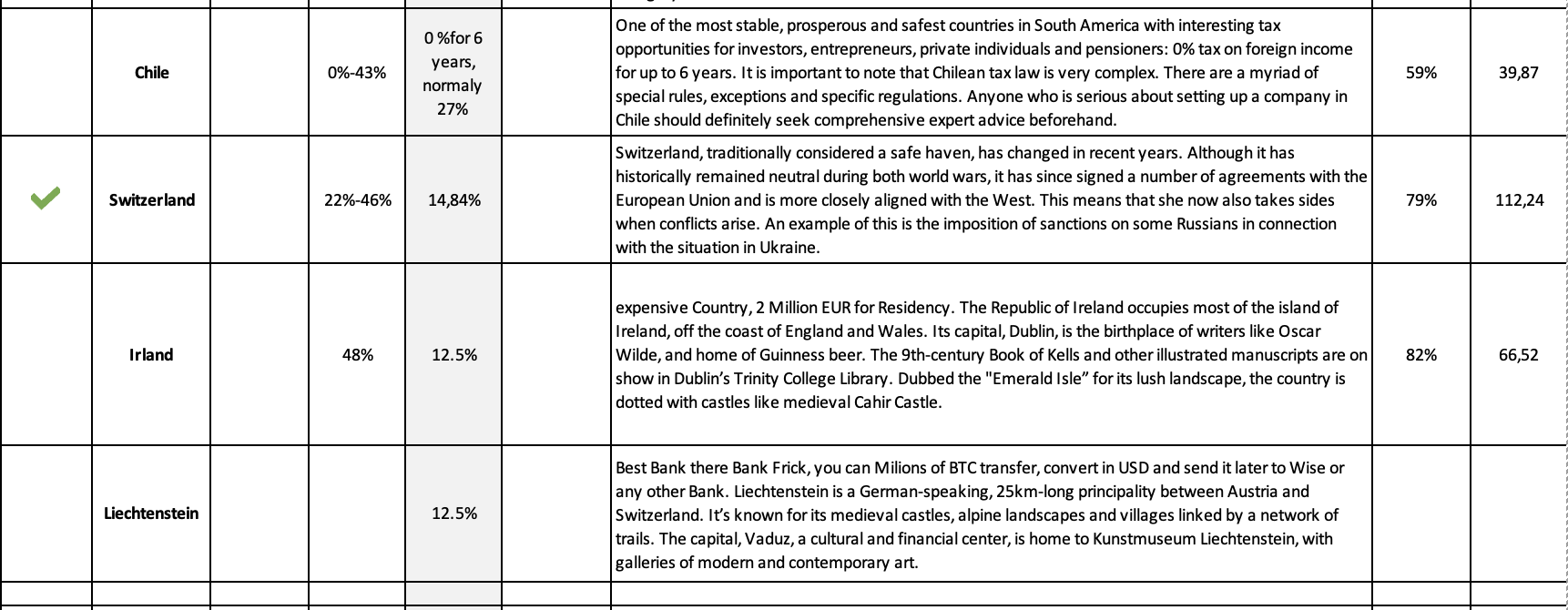

List of the best Countries in the point of Geopolitics, freedom, peace, Taxation:

**The contents of this website have been researched to the best of our knowledge and belief and provide a general overview based on data collected by an AI or taken from official statistics on the Internet, as well as our own experiences and those of our customers.

Please do not blindly rely on this information, but form your own opinion. Advice from us does not constitute legal advice, financial advice, tax advice or investment advice.

We assume no liability for the accuracy and completeness of the information provided.**

A critical look at different lifestyles:

Standard of living and culture:

In addition to tax considerations, standard of living and culture should also play a role in the choice of residence. Factors such as climate, geography, language, culture, accessibility of education and healthcare are crucial to the quality of life.

Geopolitical situation:

The current world situation is unstable and the threat of crises and conflicts is real. When choosing your country of residence, you should also consider geopolitical factors such as political stability, crime rates and especially the war propaganda of individual countries that even risk a third world war. Can you survive in Mauritius, BVI or the Cayman Islands when Armageddon comes?

In today’s world, we are faced with the choice of which country we want to live in. Should we choose a country that is rich in natural resources such as gold or minerals? Or live in a country that is one of the strongest economies through international trade, such as Singapore or Hong Kong?

These countries offer attractive economic opportunities, but are also threatened by the danger of being taken over by other major powers such as China.

Andorra, on the other hand, boasts low taxes. But this advantage comes at the cost of total state control. Surveillance cameras on every corner and the ability for neighbors to withdraw permits create a climate of fear and paternalism.

Botswana, on the other hand, offers a quiet and safe environment. But the lack of dynamism and slow pace of life could seem monotonous to some people.

In some countries, such as Germany, France and the USA, the government seems to be increasingly taking control of the lives of citizens. Restrictions on freedom of expression, paternalism and even the regulation of diet are met with criticism by many people.

In addition, some of these countries actively promote war propaganda, which leads to further tensions and conflicts in the world.

For people who value traditional values, the question arises whether they want to live in a country, where identity politics and gender issues are strongly promoted. History books and children’s books are being rewritten to take 72 different gender identities into account.

In addition to the ideological aspects, practical factors also play a role in choosing where to live:

• Education: Where are there good international schools for children?

• Work: Where are the chances of getting a good job and where can you best realize your potential as an entrepreneur?

• People: Where are the people friendly, helpful and do they speak the language?

• Finance: In which countries can you conduct your banking safely and conveniently? Which countries participate in the CRS/OECD and exchange information with the country of residence?

Conclusion:

The decision for the “right” country to live in is complex and individual. There is no one-size-fits-all answer, as various factors such as personal values, life goals and priorities must be taken into account.

It is important to find out about the different life models and their advantages and disadvantages in order to be able to make an informed decision.

**The contents of this website have been researched to the best of our knowledge and belief and provide a general overview based on data collected by an AI or taken from official statistics on the Internet, as well as our own experiences and those of our customers. Please do not blindly rely on this information, but form your own opinion. Advice from us does not constitute legal advice, financial advice, tax advice or investment advice. We assume no liability for the accuracy and completeness of the information provided.**

Secure your future with Plan B: Comprehensive support for your new beginning!

Whether you want to conquer new horizons with your family or expand your company internationally, we at GCI UNIT Worldwide will accompany you competently and reliably every step towards the future.

Our all-round carefree package for your Plan B:

Residence permit & citizenship:

We support you in effortlessly obtaining the necessary documents in all our target countries.

Company formation with strategy: Together with you, we develop the optimal strategy for your company and support you in the formation.

Bank account opening: Hassle-free account opening for your company and secure financial management.

Networking: Through our local network, you can make valuable contacts for your new beginning.

Your advantages:

Individual advice: Tailor-made concepts for your personal needs and goals.

Comprehensive support: We accompany you from start to finish – from the application to the company formation.

Fast processing: Thanks to our expertise and our network, everything progresses efficiently and quickly.

Start with Plan B now!

Arrange a free initial consultation today and get advice from our experts. Together we will shape your successful future!

—————

TCME – Group worldwide is a leading professional international foreign trade relations investment and consulting firm, with 17 different departments spread in different countries around the world, with its head office in Malaysia.

We’ve helped thousands of people take their businesses abroad, legally reduce their taxes, and become dual citizens. We focus on high-net-worth individuals and their families as well as businesses, where we design and implement bespoke, holistic strategies for successful investors and entrepreneurs to legally reduce their tax burden, diversify and protect their wealth, invest abroad, a second citizenship and to live a freer life worldwide.

Another special area of our full-service consulting is the investment opportunity and solution in Europe, especially in the Balkans, Africa, Asia, the United Arab Emirates, the Caribbean and the Pacific.

Our legal team and our 200+ multi-disciplinary team have more than 25 years of global experience in the different Consulting Areas. Governments as well as the super-rich trust in our expertise in consulting. If you are looking for it, please feel free to contact us. We create a holistic plan that serves your purpose.

YOUR CHANCE FOR A BETTER LIFE

Our range of services includes:

• Offshore and Onshore Company Formation,

• executive Search,

• IT & Cyber Security Protection

• international Business & Management Consulting

• Citizenship & Residency

• Investments & Corporate Financing

• Mining and Trading

• Advisory for Foreign Economic Relationship

• Diplomatic Consultancy & Public Affairs

If you would like to discuss your internationalization and diversification plans, book a consulting session* or email us under: [email protected]

warm regards

TCME Worldwide Group – Global Investments –

Level 33, Ilham Tower, 8 Jalan Binjai,

Kuala Lumpur 50450, Malaysia

www.tcme.company

www.citizenship-news.com

Phone: +66 99091 8357 also for WhatsApp

[email protected]