Vanuatu – Tax-free choice of residence: paradises, alternatives and important aspects

Vanuatu – Tax-free choice of residence: paradises, alternatives and important aspects

Strategies for international business activities

Use the territorial tax principle for tax-optimized profits or living in the Country like Vanuatu with 0% tax!

You have to know about Vanuatu:

It became known through the last paradise on earth.

Vanuatu, between New Zealand and Australia, an archipelago of more than 83 islands, which stretch over more than 1300 KM in the Pacific Ocean, became known as the last discovered paradise on earth. According to the Happy Planet Index, live in Vanuatu the happiest people in the world.

Situated on Tanna Island, Mount Yasur is probably one of the most popular tourist destinations in Vanuatu. It is an active volcano, towering 361 meters (1,184 feet) above sea level.

One of the most amazing blue holes in the world can be found on Espiritu Santo. The breath-taking blue holes, which are naturally-formed swimming holes with practically unreal blue waters – caused by fresh water springs climbing via sedimentary rocks, blossom across Espiritu Santo.

Amazing coral reefs and canyons decorate the shores and waterside of Vanuatu. WWII left a long lasting legacy of shipwrecks. The best known shipwreck, the S.S. President State Coolidge, was an ocean liner transformed into a troop ship when it faced a “friendly fire” U.S. mine just off Espiritu Santo. Weapons and also headgears still litter the deck of the ship, the world’s largest shipwreck accessible to scuba divers. A lot of the dives are relatively deep, in the 100-foot adventure, which requires regular decompression stops.

We would like to introduce you to the country and its people. Furthermore, we would like to offer you an insight into current real estate investments.

From swimming in a natural blue hole to standing on the rim of a live volcano, Vanuatu offers a world of adventure and discovery.

Unleash your inner-explorer and discover sights you never thought you’d see. Immerse yourself in the island’s rich and authentic culture. Make new friends and share laughter with locals who have regularly been voted some of the happiest people on the planet. Or simply come to unwind. Relax, let go and enjoy life in full swing. Embrace the freedom to do whatever you want, whenever you want.

Our company is a leading government-approved accredited agent for Vanuatu’s DSP and CIIP programs and also for other Programs in different Countries.

Citizenship by Investment Program of Vanuatu

Government Donation, Fees and due diligence Fee:

Individual Application:

USD 130,000 plus Background check (5.000 US$) and Passport Fee (160US$)

An individual application can also include parents (mom and dad) of candidate for additional USD25,000 each if they over 18 years.

Family Application (up to 4 persons):

USD 180,000 plus Background check (5.000 US$) and Passport Fee (160US$)

We may accommodate resident dependent – meaning a natural or adopted son or daughter of an applicant who is of 18 to 25 years of age and who is resident with and dependent upon an applicant or a spouse and attending full time education

each extra child onward – we may introduce a fee of USD 15,000 per person.

Each depend person cost USD 25,000.

Important / Note:

For Vanuatu you have to know the following things:

The customer must be send the money over the National Bank! The Citizenship Commission is concerned that designated and marketing agents are offering selling prices that are below the expected selling price of:

Single transfer 130,000 USD,

Married couple 150,000 USD

Family with one kid under 18 years of age 165,000 USD

Family with two kid under 18 years of age 180,000 USD

The citizenship Commission will NOT print out any citizenship certificate of an approved client unless the agent provided to us a National Bank of Vanuatu bank credit advice to confirm the total selling price was transferred to the designated agents account!

GCI UNIT Vanuatu is an approved contracted Appointed Agent by the Government from Vanuatu.

Documents for Government what we and our Lawyer need, for all the Citizenship Programs;

- signing the Contract from the main applicant (YOU), – only signing without Notary stamp and Apostil

- Ensure that your personal asset statement is over USD250,000 and bring a copy of Bank reference .

Bank Reference letter:

Simple letter from the director or Bankman

information released by a bank about a customer. Bank references generally include

(1) number of years of a customer’s relationship with the bank,

(2) number of loans and the amounts of their balances,

(3) type and quality of collateral(s) provided, and

(4) a copy of the customer’s latest statement of financial affairs on file with the bank. - clean police record, from all members over 18 years age, certificate by Notary and Apostil Stamp

- Passport copy from all members, certificate by Notary with Apostil

- birth certificate from all members, certificate by Notary with Apostil

(If no birth certificate has been issued, a statutory declaration should be made in front of notary public or relevant government authorities.) - married certificate certificate by Notary with Apostil

- residency ID Card copy, from all members certificate by Notary with Apostil

Use the territorial tax principle

for tax-optimized profits

In many countries that follow the territorial tax principle, both companies and individuals are taxed primarily on domestic income. Accordingly, foreign sources of income, such as profits from foreign branches, dividends or service income, are only subject to tax if they are transferred to the respective country or are considered to have been transferred. If this income has already been taxed in the country of origin, double taxation can be avoided.

The remittance basis of taxation and the non-dom status

In the context of the non-dom status, the so-called “remittance basis of taxation” plays a central role. This term makes it clear that only foreign income that has been transferred (“remitted”) to the country of residence or consumed there is subject to tax.

Target group for the non-dom status

The non-dom status is particularly suitable for people who are internationally active both privately and professionally and who earn foreign income of more than €250,000. A key criterion is the possibility of generating passive income abroad.

Particular interest for company founders

The Non Dom status offers attractive advantages to company founders and entrepreneurs who generate high sales with foreign subsidiaries and want to receive these tax-free.

Example scenario: Tax optimization through a US LLC

Let’s assume you set up a tax-free LLC in the USA. This generates commissions of $500,000 by working with Asian partners (you can find more information on setting up a company in the USA here). As a Non Dom status holder, you enjoy complete tax exemption on these $500,000 as long as they are not transferred to an account in your country of residence.

Disclaimer:

Please note that this is only a general overview and individual tax advice from an expert is required to assess the specific impact of the Non Dom status on your situation.

Tax-optimized choice of residence: paradises, alternatives and important aspects

The search for a residence with an optimal tax burden is a relevant topic for many people. Below we look at various options and the factors associated with them.

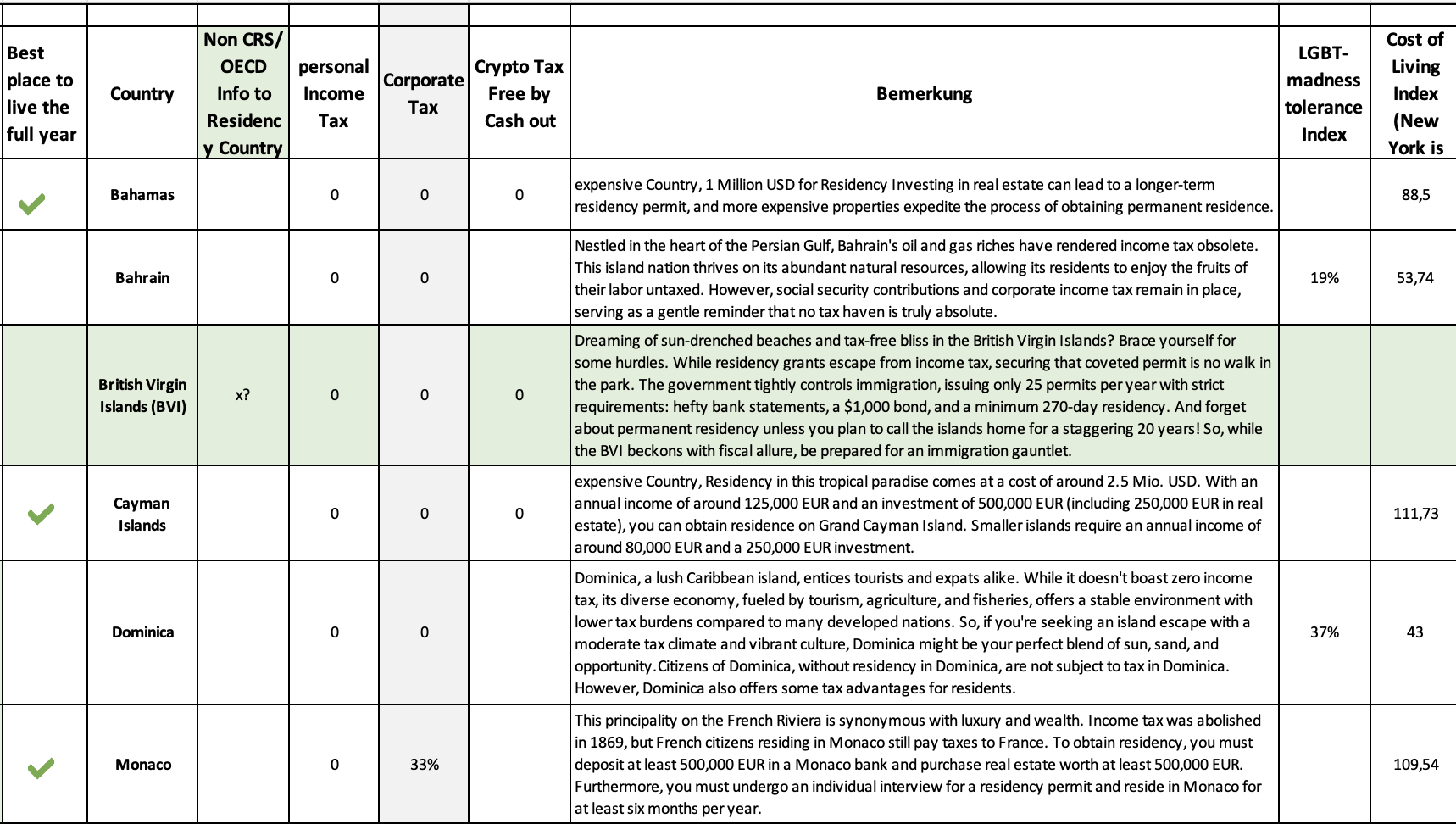

Tax havens with 0% tax:

Countries such as Vanuatu, Bahamas, Bahrain, British Virgin Islands and Cayman Islands lure with the promise of no income tax at all.

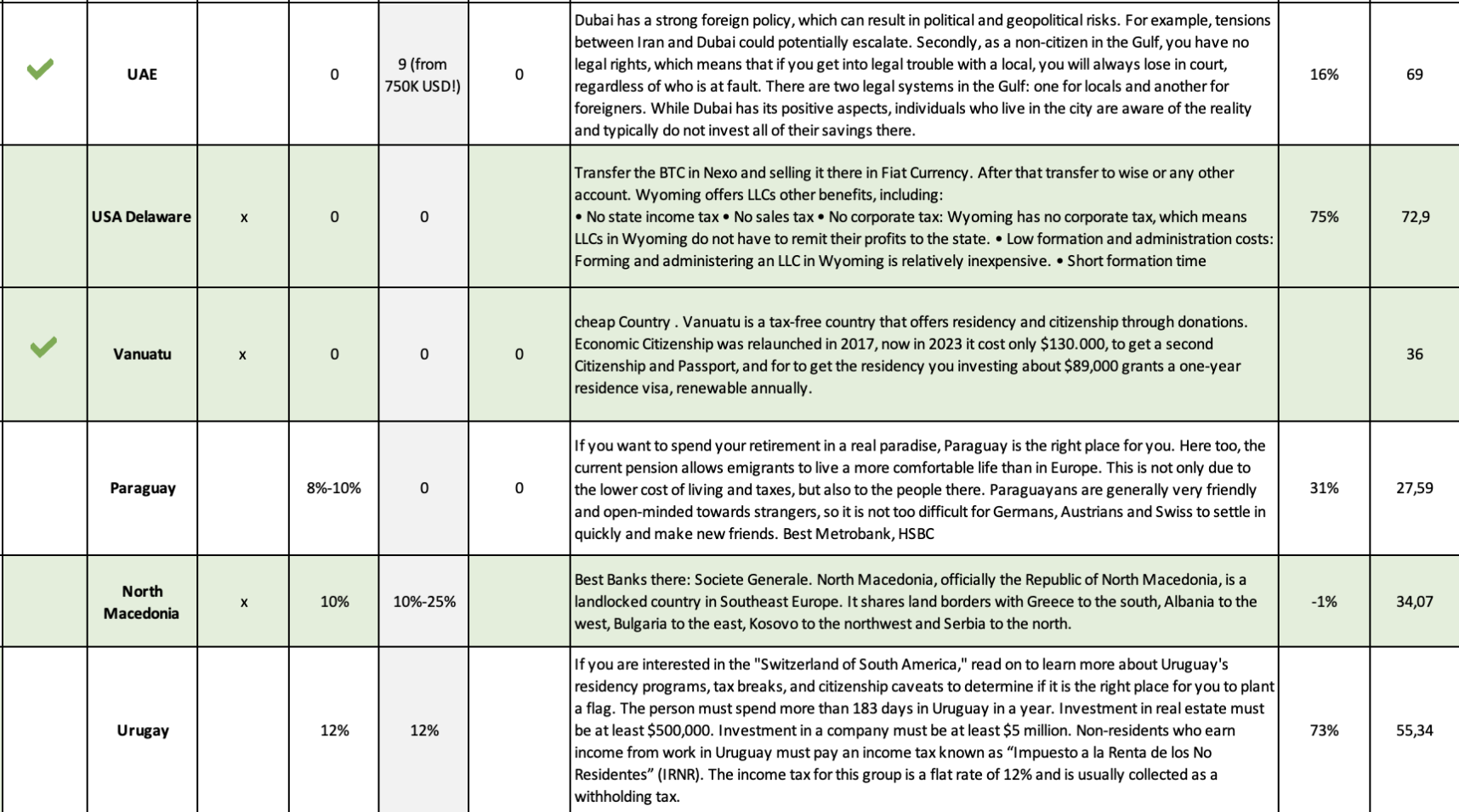

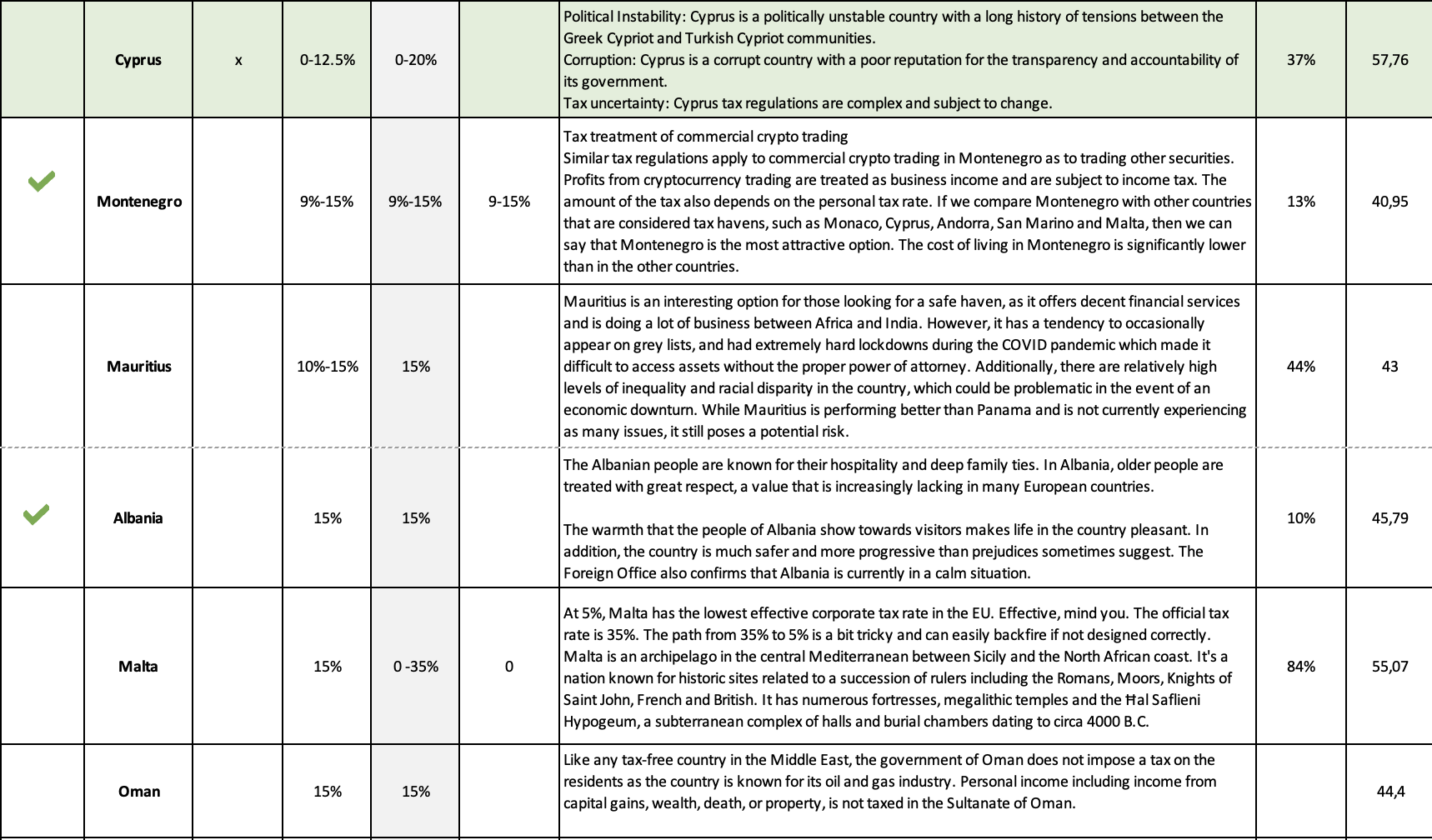

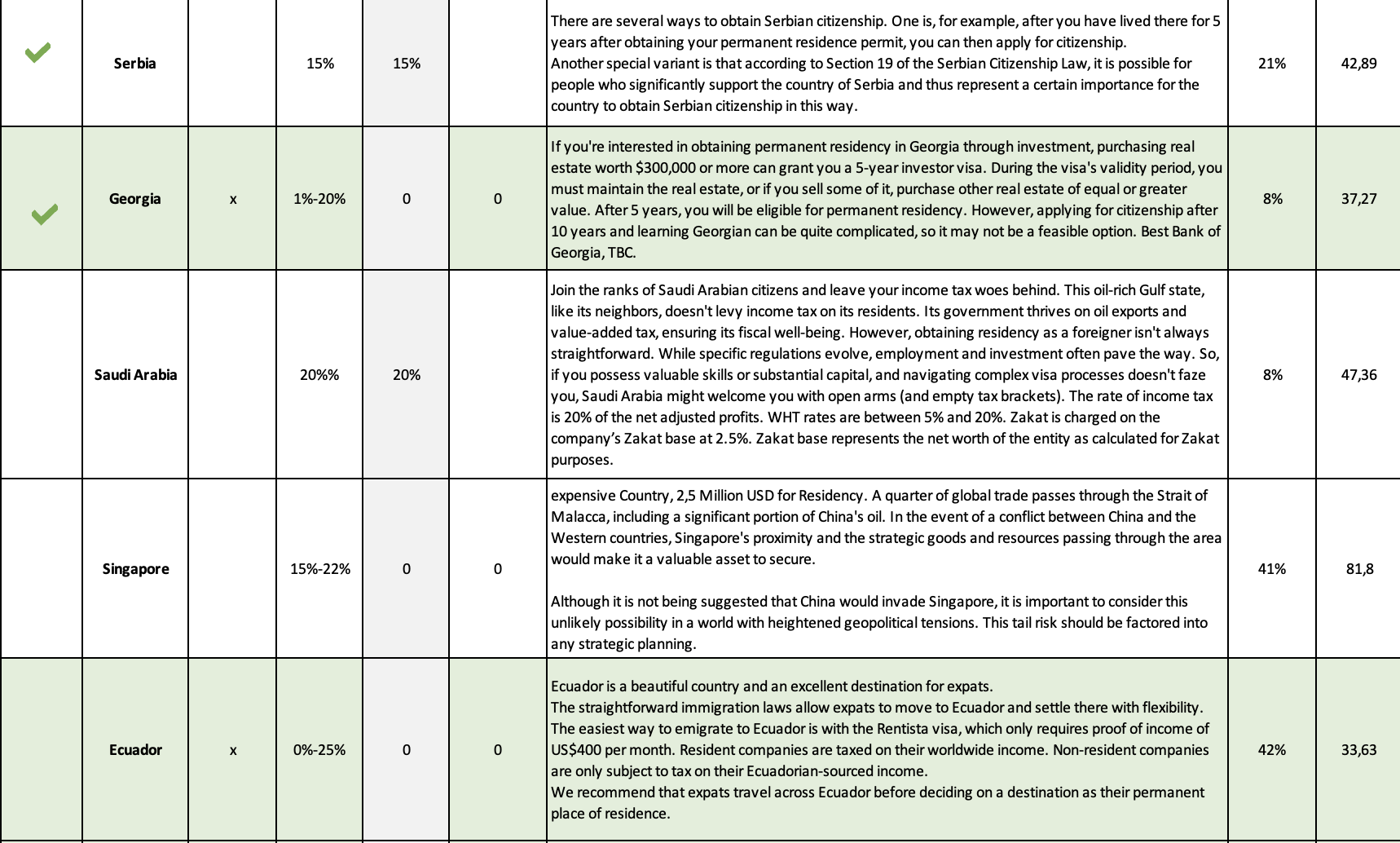

Countries with a low tax burden:

An attractive alternative is offered by countries such as Paraguay, Oman, Montenegro, Malta, Georgia, Albania, Serbia, Uruguay, UAE, Singapore and Mauritius. They are characterized by low income taxes and corporate taxes and at the same time offer:

• Higher standard of living and infrastructure: The quality of life and infrastructure in these countries are often significantly better compared to tax havens.

• Greater opportunities for international activities: The connection to the global economy and the opportunities for international business relations are better developed.

• Lower reputation risk: These countries generally enjoy a better international reputation.

Residence and company formation strategy:

The combination of residence in a low-tax country and the formation of a company in an offshore company with a low tax rate can further reduce the tax burden. However, the following applies:

Taxation of profit distributions: Profits distributed from the offshore company to the country of residence are generally subject to taxation.

Complexity and legislation: Implementing and managing this strategy requires in-depth knowledge of tax law and international corporate structures.

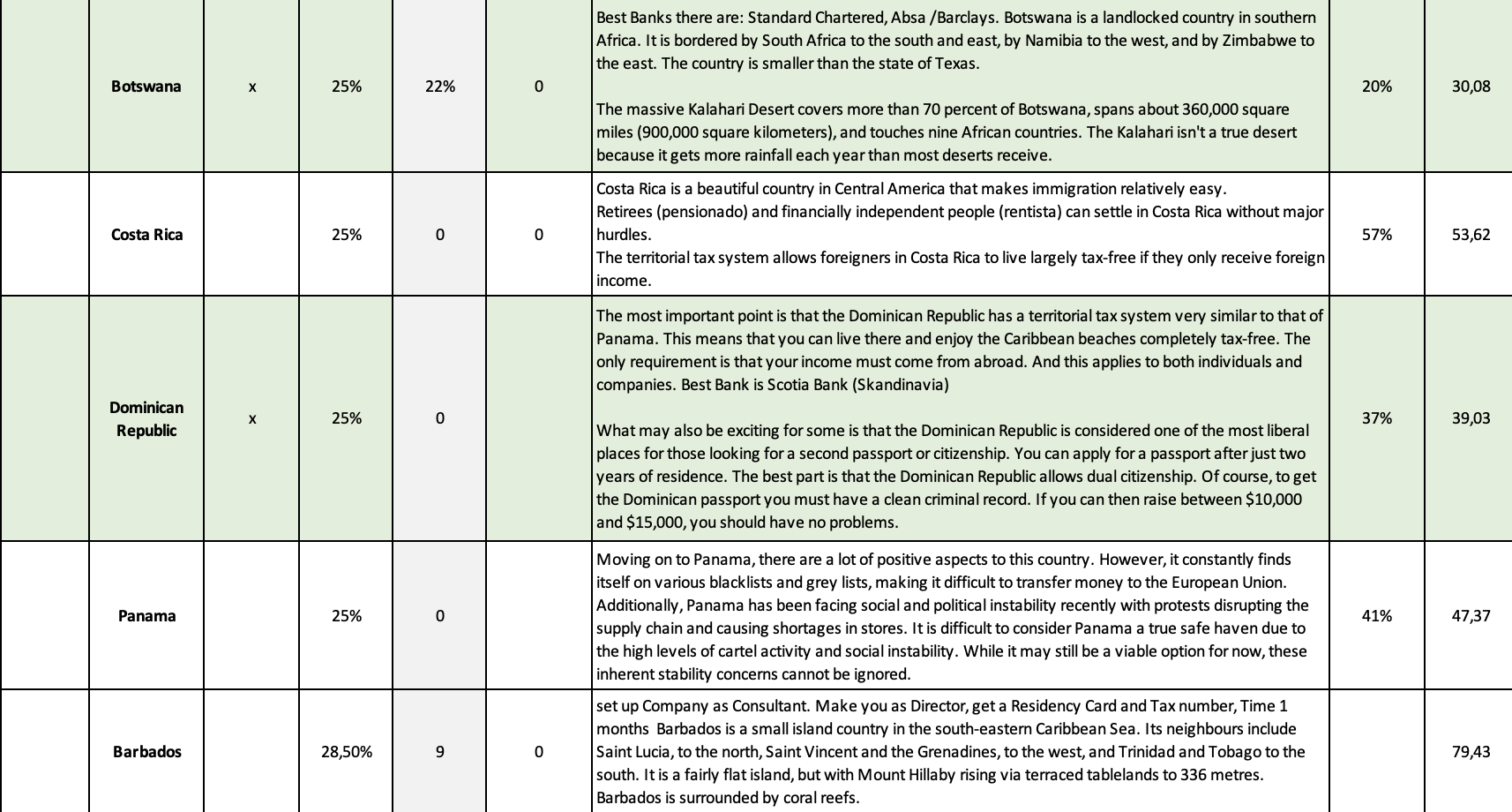

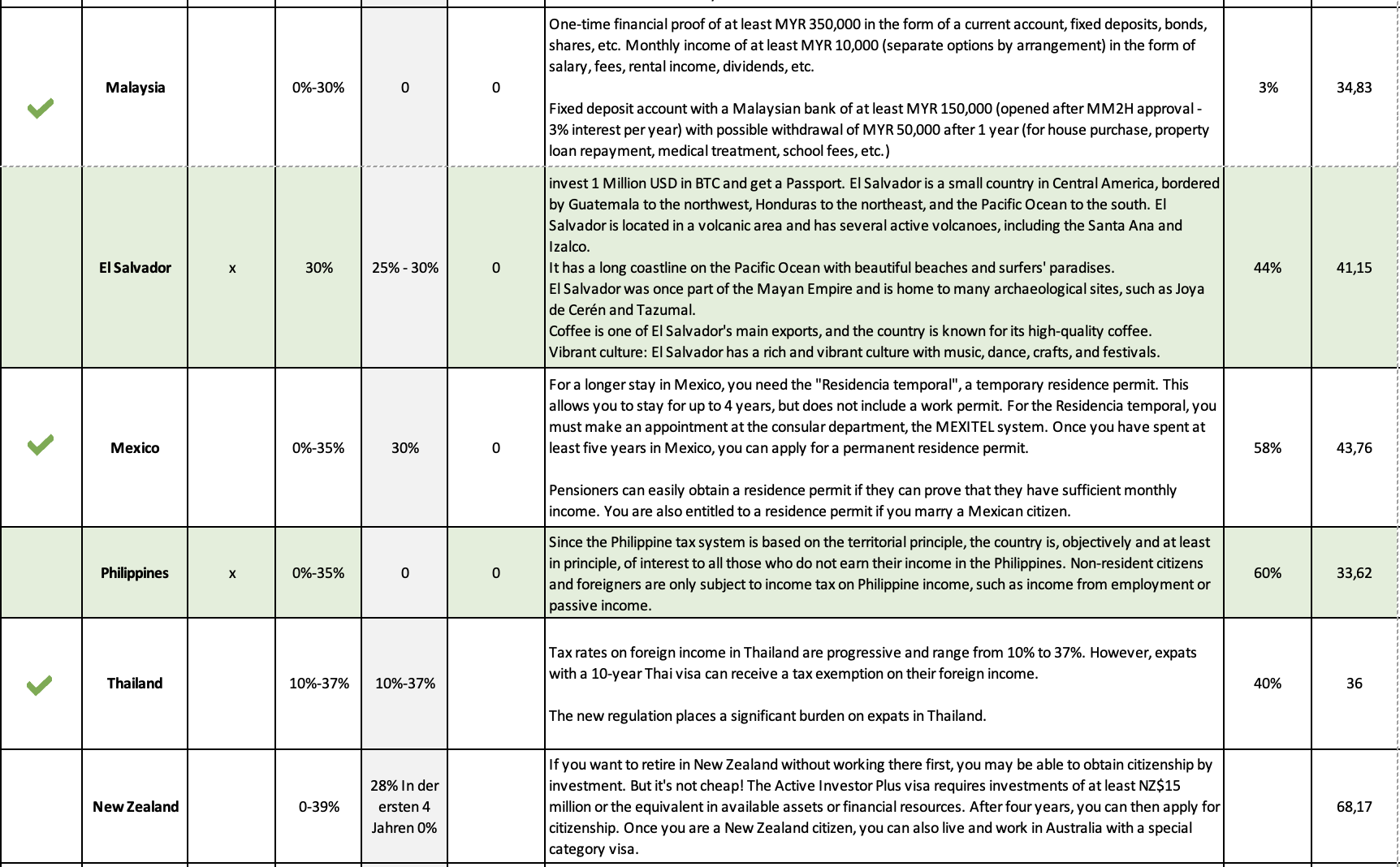

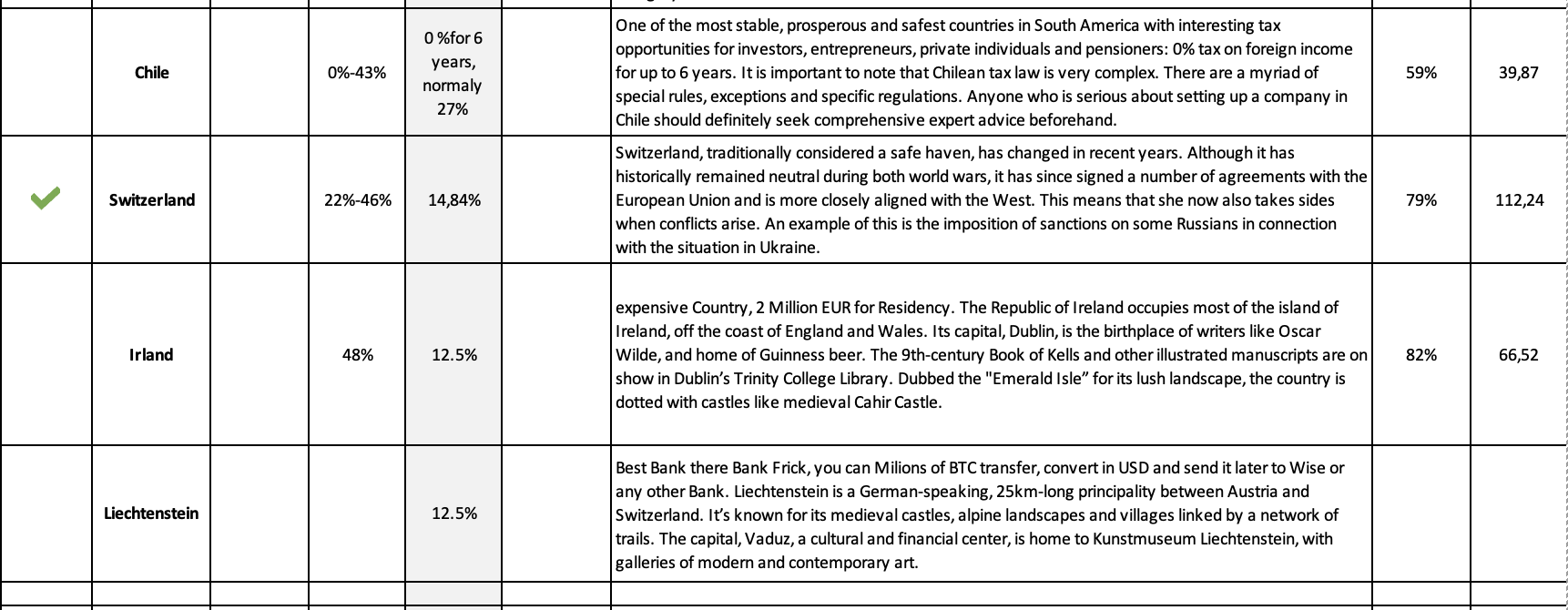

List of the best Countries in the point of Geopolitics, freedom, peace, Taxation:

**The contents of this website have been researched to the best of our knowledge and belief and provide a general overview based on data collected by an AI or taken from official statistics on the Internet, as well as our own experiences and those of our customers.

Please do not blindly rely on this information, but form your own opinion. Advice from us does not constitute legal advice, financial advice, tax advice or investment advice.

We assume no liability for the accuracy and completeness of the information provided.**

A critical look at different lifestyles:

Standard of living and culture:

In addition to tax considerations, standard of living and culture should also play a role in the choice of residence. Factors such as climate, geography, language, culture, accessibility of education and healthcare are crucial to the quality of life.

Geopolitical situation:

The current world situation is unstable and the threat of crises and conflicts is real. When choosing your country of residence, you should also consider geopolitical factors such as political stability, crime rates and especially the war propaganda of individual countries that even risk a third world war. Can you survive in Mauritius, BVI or the Cayman Islands when Armageddon comes?

In today’s world, we are faced with the choice of which country we want to live in. Should we choose a country that is rich in natural resources such as gold or minerals? Or live in a country that is one of the strongest economies through international trade, such as Singapore or Hong Kong?

These countries offer attractive economic opportunities, but are also threatened by the danger of being taken over by other major powers such as China or the USA.

The USA is known as a (former) empire that actively represents its interests worldwide and, when in doubt, intervenes militarily to pursue its own goals, often under the guise of the “common good”.

Andorra, on the other hand, boasts low taxes. But this advantage comes at the cost of total state control. Surveillance cameras on every corner and the ability for neighbors to withdraw permits create a climate of fear and paternalism.

Botswana, on the other hand, offers a quiet and safe environment. But the lack of dynamism and slow pace of life could seem monotonous to some people.

In some countries, such as Germany, France and the USA, the government seems to be increasingly taking control of the lives of citizens. Restrictions on freedom of expression, paternalism and even the regulation of diet are met with criticism by many people.

In addition, some of these countries actively promote war propaganda, which leads to further tensions and conflicts in the world.

For people who value traditional values, the question arises whether they want to live in a country like Germany, where identity politics and gender issues are strongly promoted. History books and children’s books are being rewritten to take 72 different gender identities into account.

In addition to the ideological aspects, practical factors also play a role in choosing where to live:

• Education: Where are there good international schools for children?

• Work: Where are the chances of getting a good job and where can you best realize your potential as an entrepreneur?

• People: Where are the people friendly, helpful and do they speak the language?

• Finance: In which countries can you conduct your banking safely and conveniently? Which countries participate in the CRS/OECD and exchange information with the country of residence?

Conclusion:

The decision for the “right” country to live in is complex and individual. There is no one-size-fits-all answer, as various factors such as personal values, life goals and priorities must be taken into account.

It is important to find out about the different life models and their advantages and disadvantages in order to be able to make an informed decision.

**The contents of this website have been researched to the best of our knowledge and belief and provide a general overview based on data collected by an AI or taken from official statistics on the Internet, as well as our own experiences and those of our customers. Please do not blindly rely on this information, but form your own opinion. Advice from us does not constitute legal advice, financial advice, tax advice or investment advice. We assume no liability for the accuracy and completeness of the information provided.**

Secure your future with Plan B: Comprehensive support for your new beginning!

Whether you want to conquer new horizons with your family or expand your company internationally, we at GCI UNIT Worldwide from TCME – Group worldwide will accompany you competently and reliably every step towards the future.

Our all-round carefree package for your Plan B:

Residence permit & citizenship:

We support you in effortlessly obtaining the necessary documents in all our target countries.

Company formation with strategy: Together with you, we develop the optimal strategy for your company and support you in the formation.

Bank account opening: Hassle-free account opening for your company and secure financial management.

Networking: Through our local network, you can make valuable contacts for your new beginning.

Your advantages:

Individual advice: Tailor-made concepts for your personal needs and goals.

Comprehensive support: We accompany you from start to finish – from the application to the company formation.

Fast processing: Thanks to our expertise and our network, everything progresses efficiently and quickly.

Start with Plan B now!

Arrange a free initial consultation today and get advice from our experts. Together we will shape your successful future!

—————

TCME – Group worldwide is a leading professional international foreign trade relations investment and consulting firm, with 17 different departments spread in different countries around the world, with its head office in Malaysia.

Our company is a leading government-approved accredited agent for Vanuatu’s DSP and CIIP programs and also for other Programs in different Countries.

We’ve helped thousands of people take their businesses abroad, legally reduce their taxes, and become dual citizens. We focus on high-net-worth individuals and their families as well as businesses, where we design and implement bespoke, holistic strategies for successful investors and entrepreneurs to legally reduce their tax burden, diversify and protect their wealth, invest abroad, a second citizenship and to live a freer life worldwide.

Another special area of our full-service consulting is the investment opportunity and solution in Europe, especially in the Balkans, Africa, Asia, the United Arab Emirates, the Caribbean and the Pacific.

Our legal team and our 200+ multi-disciplinary team have more than 25 years of global experience in the different Consulting Areas. Governments as well as the super-rich trust in our expertise in consulting. If you are looking for it, please feel free to contact us. We create a holistic plan that serves your purpose.

YOUR CHANCE FOR A BETTER LIFE

Our range of services includes:

• Offshore and Onshore Company Formation,

• executive Search,

• IT & Cyber Security Protection

• international Business & Management Consulting

• Citizenship & Residency

• Investments & Corporate Financing

• Mining and Trading

• Advisory for Foreign Economic Relationship

• Diplomatic Consultancy & Public Affairs

If you would like to discuss your internationalization and diversification plans, book a consulting session* or email us under: [email protected]

warm regards

TCME Worldwide Group – Global Investments –

Level 33, Ilham Tower, 8 Jalan Binjai,

Kuala Lumpur 50450, Malaysia

www.tcme.company

www.citizenship-news.com

Phone: +66 99091 8357 also for WhatsApp

[email protected]