In which country within Europe do you not have to pay taxes on foreign income?

In which country within Europe do you not have to pay taxes on foreign income?

In Europe, the following countries currently do not levy taxes on foreign income:

Andorra

Andorra is a small country in the Pyrenees between France and Spain. It is a popular holiday destination for winter sports enthusiasts and hikers. The country is known for its tax advantages, which make it a popular destination for the rich and famous.

Benefits for visitors:

Natural beauties: Andorra is a country with breathtaking nature. The Pyrenees offer excellent opportunities for hiking, skiing and other outdoor activities.

Tax advantages: Andorra does not charge income tax on income from its own country. This makes it an attractive destination for retirees and entrepreneurs.

Quality of Life: Andorra offers a high quality of life with a good healthcare system and a safe environment.

Disadvantages for investors:

Low economic output: Andorra has a low economic output and is heavily dependent on tourism.

Tight financial system: Andorra’s financial system is narrow and can be difficult for investors to penetrate.

Tax uncertainty: Andorra’s tax advantages are not guaranteed and are subject to change.

Monaco

Monaco is a small principality on the Côte d’Azur. It is known for its wealth, glamor and casinos. Monaco is a popular destination for tourists and investors.

Benefits for visitors:

Climate: Monaco has a mild climate with warm summers and mild winters.

Culture: Monaco is a cultural center with a rich history and tradition.

Luxury: Monaco offers a luxurious lifestyle with first-class hotels, restaurants and shops.

Disadvantages for investors:

High cost of living: The cost of living in Monaco is very high.

Low economic output: Monaco has a low economic output and is heavily dependent on tourism.

Tax uncertainty: Monaco’s tax regulations are complex and subject to change.

San Marino

San Marino is a small republic in the Apennines between Italy and the Adriatic. It is the oldest still existing country in the world. San Marino is a popular destination for tourists and investors.

Benefits for visitors:

History: San Marino is a country with a rich history and tradition.

Culture: San Marino is a cultural center with a number of museums, galleries and theaters.

Nature: San Marino offers a variety of natural attractions including mountains, forests and lakes.

Disadvantages for investors:

Low economic output: San Marino has a low economic output and is heavily dependent on tourism.

Tight financial system: San Marino’s financial system is narrow and can be difficult for investors to penetrate.

Tax Uncertainty: San Marino’s tax regulations are complex and subject to change.

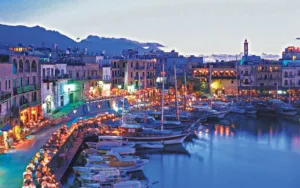

Cyprus

Cyprus is an island in the Mediterranean. It is a popular holiday destination for sunbathers, beach lovers and history buffs. Cyprus is also a popular destination for investors.

Benefits for visitors:

Climate: Cyprus has a mild climate with warm summers and mild winters.

Beaches: Cyprus has some of the most beautiful beaches in the Mediterranean.

History: Cyprus has a long and rich history dating back to ancient times.

Disadvantages for investors:

Political Instability: Cyprus is a politically unstable country with a long history of tensions between the Greek Cypriot and Turkish Cypriot communities.

Corruption: Cyprus is a corrupt country with a poor reputation for the transparency and accountability of its government.

Tax uncertainty: Cyprus tax regulations are complex and subject to change.

Estonia

Estonia is a Baltic country on the Baltic Sea coast. It is a popular destination for tourists and investors. Estonia is known for its digital economy, clean environment and friendly population.

Benefits for visitors:

Nature: Estonia is a country with a variety of natural attractions, including forests, lakes and coastal areas.

Culture: Estonia has a long and rich history that is reflected in its culture.

Digital economy: Estonia is a pioneer in the digital economy and offers a variety of opportunities for entrepreneurs and investors.

Disadvantages for investors:

Small Economy: Estonia is a small economy with limited opportunities for larger businesses.

Language barrier: The Estonian language is a Finno-Ugric language that is difficult for many people to learn.

Administration: Estonian administration can sometimes be bureaucratic and time-consuming

Latvia

Latvia is a Baltic country on the Baltic Sea coast. It is a popular destination for tourists and investors. Latvia is known for its historic old town, beautiful nature and friendly people.

Benefits for visitors:

Culture: Latvia has a long and rich history that is reflected in its culture.

Nature: Latvia is a country with a variety of natural attractions, including forests, lakes and coastal areas.

Quality of life: Latvia offers a high quality of life with a good healthcare system and a safe environment.

Disadvantages for investors:

Small Economy: Latvia is a small economy with limited opportunities for larger businesses.

Language barrier: The Latvian language is a Baltic language that is difficult for many people to learn.

Administration: Latvian administration can sometimes be bureaucratic and time-consuming.

Lithuania

Lithuania is a Baltic country on the Baltic Sea coast. It is a popular destination for tourists and investors. Lithuania is known for its historic old town, beautiful nature and friendly people.

Benefits for visitors:

Culture: Lithuania has a long and rich history that is reflected in its culture.

Nature: Lithuania is a country with a variety of natural attractions, including forests, lakes and coastal areas.

Quality of life: Lithuania offers a high quality of life with a good healthcare system and a safe environment.

Disadvantages for investors:

Small Economy: Lithuania is a small economy with limited opportunities for larger businesses.

Language barrier: The Lithuanian language is a Baltic language that is difficult for many people to learn.

Administration: Lithuanian administration can sometimes be bureaucratic and time-consuming

Malta

Malta is an island in the Mediterranean. It is a popular destination for tourists and investors. Malta is known for its long history, beautiful architecture and friendly people.

Benefits for visitors:

Climate: Malta has a mild climate with warm summers and mild winters.

History: Malta has a long and rich history that is reflected in its architecture and culture.

Quality of Life: Malta offers a high quality of life with a good healthcare system and a safe environment.

Disadvantages for investors:

High cost of living: The cost of living in Malta is very high.

Small Economy: Malta is a small economy with limited opportunities for larger businesses.

Tax uncertainty: Malta’s tax rules are complex and subject to change.

In summary, all of these countries offer their own unique advantages and disadvantages for visitors and investors. Deciding which country to invest in depends on a number of factors, including personal preferences, financial capabilities and business goals.

“These countries are often referred to as tax havens because they represent an attractive destination for tax evaders. In some cases, these countries levy taxes on income earned in their country but not on income earned in other countries.”

List of taxes on income within the country:

List of these countries that do not levy taxes on your foreign income, but if you live there and work within this country,

you pay the following income tax and corporate tax:

| Country | VAT | Corporate tax | Income tax |

| Andorra | 21 % | 10 % | 10 % |

| Monaco | 21 % | 33 % | 0 % |

| San Marino | 22 % | 27 % | 10 % |

| Zypern | 19 % | 12,5 % | 20 % |

| Estland | 20 % | 20 % | 20 % |

| Lettland | 21 % | 20 % | 20 % |

| Litauen | 21 % | 15 % | 20 % |

| Malta | 18 % | 15 % | 25 % |

It is important to note that the taxation of foreign income depends not only on the national tax laws of the respective country, but also on the double taxation treaties that that country has concluded with other countries. Double taxation agreements are intended to prevent income from being taxed twice.

For example, a taxpayer resident in Cyprus who receives income from Germany may not have to pay taxes on that income in Cyprus, but is still liable to pay German income tax in Germany. This depends on what provisions the double taxation agreement between Cyprus and Germany contains.

In practice, it is therefore advisable to find out about the exact tax implications before moving your residence to a country without income tax.

Montenegro: The insider tip for investors

Montenegro is a small country in southeastern Europe, bordering Albania, Bosnia and Herzegovina, Croatia and Serbia. It is known for its breathtaking nature, historic architecture and hospitable people. In recent years, Montenegro has also gained attention as an attractive destination for investors.

Why Montenegro is so attractive for investors

There are many reasons why Montenegro is so attractive for investors. This includes:

- Attractive tax rates: Montenegro offers a number of tax advantages for investors, including a flat tax of 9% on corporate profits, a withholding tax of 15% on dividends and an income tax of 9% on income from employment.

- Cheap cost of living: The cost of living in Montenegro is relatively low compared to other European countries. In Montenegro, a cup of coffee costs around 1 euro, a meal in a restaurant costs around 10 euros and rent for a 3-room apartment costs around 500 euros per month.

- Increasing economic growth: Montenegro’s economy has been growing steadily for years. In 2023, economic growth was 7.5%.

- EU accession: Montenegro is on the way to joining the EU. Accession is expected to take place in the next few years.

Montenegro compared to other countries

If you compare Montenegro with other countries that are considered tax havens, such as Monaco, Cyprus, Andorra, San Marino and Malta, then it can be said that Montenegro is the most attractive option. The cost of living in Montenegro is significantly lower than in other countries. Additionally, Montenegro is a member of the European Union, which means it has access to the European internal market.

If you compare Montenegro with countries known for their cold and rainy climate, such as Estonia, Latvia and Lithuania, then you can say that Montenegro is a much more attractive destination. Montenegro has a warm and sunny climate with mild winters and hot summers.

Conclusion

Montenegro is an attractive destination for investors looking for a country with attractive tax rates, low cost of living, steadily growing economy and EU membership prospects. The country offers a unique combination of nature, culture and history.

If you have further questions about the tax haven or would like to find out more about the respective residence permits or citizenship programs in general, please contact us and arrange a consultation.

TCME – Group worldwide is a leading professional international foreign trade relations investment and consulting firm, with 17 different departments spread in different countries around the world, with its head office in Malaysia.

We’ve helped thousands of people take their businesses abroad, legally reduce their taxes, and become dual citizens. We focus on high-net-worth individuals and their families as well as businesses, where we design and implement bespoke, holistic strategies for successful investors and entrepreneurs to legally reduce their tax burden, diversify and protect their wealth, invest abroad, a second citizenship and to live a freer life worldwide.

Another special area of our full-service consulting is the investment opportunity and solution in Europe, especially in the Balkans, Africa, Asia, the United Arab Emirates, the Caribbean and the Pacific.

Our legal team and our 200+ multi-disciplinary team have more than 25 years of global experience in the different Consulting Areas. Governments as well as the super-rich trust in our expertise in consulting. If you are looking for it, please feel free to contact us. We create a holistic plan that serves your purpose.

YOUR CHANCE FOR A BETTER LIFE

Our range of services includes:

• Offshore and Onshore Company Formation,

• executive Search,

• IT & Cyber Security Protection

• international Business & Management Consulting

• Citizenship & Residency

• Investments & Corporate Financing

• Mining and Trading

• Advisory for Foreign Economic Relationship

• Diplomatic Consultancy & Public Affairs

If you would like to discuss your internationalization and diversification plans, book a consulting session* or email us under: [email protected]

*A counseling session is a conversation about your portfolio and goals. It does not constitute legal, financial, tax or investment advice.

TCME Worldwide Group – Global Investments –

Level 33, Ilham Tower, 8 Jalan Binjai,

Kuala Lumpur 50450, Malaysia

www.tcme.company

www.citizenship-news.com

Phone: +66 99091 8357 also for WhatsApp

[email protected]