Government of Germany and Europe plan expropriations “You will have nothing but be happy”

Government of Germany and Europe plan expropriations “You will have nothing but be happy”

“You will have nothing but be happy”

Expropriations could possibly be imminent in Germany, possibly as early as 2024, if one interprets the first indications from the federal government. Still, many people don’t take these warnings seriously enough. Common reactions are “this only affects the wealthy” or “it affects the right people”. Aside from the question of whether such positions are questionable in a democracy, these views are fundamentally wrong. The intention of the governments in Germany and Europe is to rehabilitate themselves through financial measures at the expense of all citizens. Information on the progress of these plans and the potential danger, as well as whether the assumption of a “planned expropriation in 2024” is justified can be found in this post.

(“You will have nothing but be happy”)

In a previous article, we reported extensively on the serious impact of inflation on our wealth. In summary, the high inflation leads to significant price increases for essential goods and contributes to the impoverishment of the German population. However, these problems are homegrown. The excessive money creation, followed by bond purchases by the European Central Bank, economically devastating corona lockdowns and sanctions against Russia are not random events, but deliberately politically controlled. However, should the government actually implement an expropriation in 2024, property owners should start thinking about alternative plans now.

Ultimately, it is the citizen who pays for ideological deviations with the proceeds of his labor and savings. In Germany alone, more than 2.4 trillion euros in government debt have to be dealt with.

Did you know that a possible expropriation in 2024 would not be the first time in the history of the Federal Republic? The concept of “load balancing” is essentially synonymous with “cost sharing”. A burden is spread over many shoulders. This term arose shortly after World War II. At that time, compulsory mortgages of up to 50% were levied on people’s assets, especially real estate.

This measure supported war victims with additional income. Refugees, war veterans, prisoners and their families had access to this fund. In addition, people who had financial difficulties as a result of the conversion from the Reichsmark to the D-Mark received support. In 1948, the values of real estate were also determined, the owners of which had to pay a wealth tax of 1.6% for 30 years. This was an important part of the expropriation law in Germany, which prevented property owners from being forced to sell their homes. Nevertheless, sufficient money was available for the state. You can find more information under the term “Expropriation Germany 1952” on the Internet. This is how the “Burden Equalization Act” came into being.

The question may arise, “Is the possibility of government expropriation in 2024 realistic?” In such a case, mechanisms similar to those in 1948 could apply. If the government revisits the concept of the Burdens Equalization Act in 2024, there are legitimate concerns about potential homeownership expropriation.

Why does government expropriation seem likely? The state is constantly looking for additional sources of income, especially if they can be obtained easily. An extremely attractive option is the taxation of real estate assets, which currently have a total value of around 14.7 trillion euros in Germany. This immense value could explain a possible government expropriation in 2024. After all, this amount corresponds to four times the total German gross domestic product. Taxation would thus be almost like a gift for the government and the treasury.

A government expropriation could also come under a different name. As substantial as the debt is, as far-reaching are the measures taken by the state to win it over from its own population. Whether it’s called inflation, a wealth tax, or burden sharing, it’s actually expropriation. This happens insidiously and is not immediately obvious at first.

An example of this can be seen in the Bavarian district of Fürstenfeldbruck. First, residents of a retirement home in Spielberg had to vacate the lower floor because some beds were empty. After that, District Administrator Thomas Karmasin (CSU) even announced the expropriation of empty farm buildings to accommodate refugees there.

What at first glance seems like a decision in the interests of the common good and solidarity quickly turns out to be a sign of an impending threat to our assets. Something is brewing behind the scenes. The state is getting greedy and is now conducting initial test runs. If there is little resistance, the encroachments on property rights and individual freedoms could be expanded in a similar way to the Corona measures.

The federal government relies on Article 14 of the Basic Law, which protects property in principle, but allows expropriations “only for the public good”. However, the term “common good” is extremely vaguely defined. The door to abuse seems wide open.

In Berlin, the red-red-green state government is currently exploring the border. For years, their declared goal has been to nationalize, i.e. to expropriate, the city’s large housing construction companies. This measure is referred to as “socialization”, which downplays the actually serious intervention.

Under the pretext of wanting to combat vacancies in apartments, politicians are intervening in private property. A supposedly independent commission of experts (which actually consists exclusively of representatives of the Senate administrations involved) is currently examining the legal basis for the planned expropriation.

And what do Berliners say about it? They are mostly in favour, as a referendum in September 2021 showed. A whopping 59 percent of Spreeatheners were in favor of the expropriation of the large (more than 3,000 apartments) housing associations. According to the motto: They only take it away from the big ones, they never want to touch our property. In Berlin, of all places, they have forgotten how socialism à la GDR made (almost) everyone poor.

Political leaders try to whitewash expropriations.

This obsession with expropriation doesn’t stop at buildings either. Spurred on by the demand by the former chairwoman of the Left Party, Petra Kipping, that the SPD should act more courageously in the expropriation debate, the former JUSO chairman and current SPD Secretary General Kevin Kühnert brought up the idea of expropriating investors with more than 20 apartments in 2019 (in the ARD) and the transformation of BMW into a “cooperative automobile company” (in Die Zeit).

However, the word “expropriation” is avoided. Instead, euphemistic terms such as burden sharing, collectivization or socialization are used today. Then, like Kühnert, they demand “democratic control over the distribution of profits”.

And so the next potential risk hovers over Germany: the so-called burden sharing. This has been enshrined in law since 1952. At that time, the heavily indebted state grabbed 50 percent of the assets of wealthy Germans to support displaced persons and victims of the Second World War. It was the largest redistribution that has ever taken place in a market economy.

Load balancing (Lastenausgleich) & Co. – A worrying development

In 2019, the Bundestag initiated an amendment to the existing Equalization of Burdens Act and expanded the group of beneficiaries. From January 2024, not only victims of war can claim compensation, but also victims of violence, terrorist attacks and even people who have been harmed by vaccinations. This means that citizens could now also be held responsible for increasingly obvious vaccination consequences.

The state is currently busy collecting information about citizens’ wealth. An example of this is the planned central real estate register. Once the government has knowledge of apartment sizes and occupants, this could pave the way for possible forced billeting, for example of refugees.

The current restructuring of the property tax is also worrying. Apart from the additional expense of separate tax returns, the data collected could serve as a solid basis for a feared mandatory asset levy.

The state could even go further and introduce confiscations. The difference here is that in the case of expropriations, “fair” compensation is provided for. It remains questionable how a nearly insolvent state would raise the funds for such compensation. In this context, confiscation may be the only option left.

This possibility is already a reality in Hamburg. During the first wave of refugees in 2015, Hamburg’s parliament passed a law that made it possible to confiscate commercial real estate.

————

TCME – Group worldwide is a leading professional international foreign trade relations investment and consulting firm, with 17 different departments spread in different countries around the world, with its head office in Malaysia.

We’ve helped thousands of people take their businesses abroad, legally reduce their taxes, and become dual citizens. We focus on high-net-worth individuals and their families as well as businesses, where we design and implement bespoke, holistic strategies for successful investors and entrepreneurs to legally reduce their tax burden, diversify and protect their wealth, invest abroad, a second citizenship and to live a freer life worldwide.

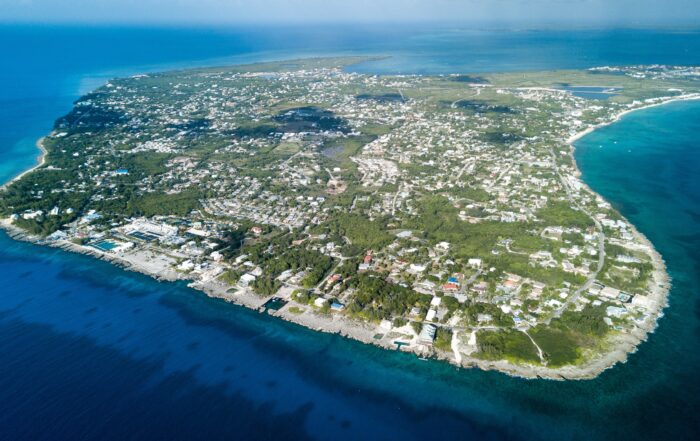

Another special area of our full-service consulting is the investment opportunity and solution in Europe, especially in the Balkans, Africa, Asia, the United Arab Emirates, the Caribbean and the Pacific.

Our legal team and our 200+ multi-disciplinary team have more than 25 years of global experience in the different Consulting Areas. Governments as well as the super-rich trust in our expertise in consulting. If you are looking for it, please feel free to contact us. We create a holistic plan that serves your purpose.

YOUR CHANCE FOR A BETTER LIFE

Our range of services includes:

• Offshore and Onshore Company Formation,

• executive Search,

• IT & Cyber Security Protection

• international Business & Management Consulting

• Citizenship & Residency

• Investments & Corporate Financing

• Mining and Trading

• Advisory for Foreign Economic Relationship

• Diplomatic Consultancy & Public Affairs

If you would like to discuss your internationalization and diversification plans, book a consulting session* or email us under: [email protected]

*A counseling session is a conversation about your portfolio and goals. It does not constitute legal, financial, tax or investment advice.

TCME Worldwide Group – Global Investments –

Level 33, Ilham Tower, 8 Jalan Binjai,

Kuala Lumpur 50450, Malaysia

www.tcme.company

www.citizenship-news.com

Phone: +66 99091 8357 also for WhatsApp

[email protected]